THURSDAY, FEBRUARY 25, 2016

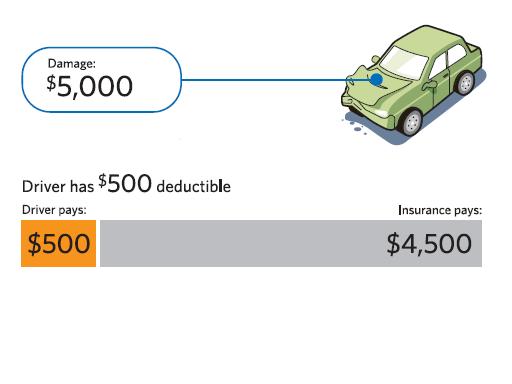

A deductible on a car insurance policy is a pre-determined amount of money that you must pay before your insurer will cover a claim. Deductibles generally only apply to comprehensive and collision coverage (if you purchased them).

Comp/collision coverage apply to a number of incidents in which the vehicle is stolen or damaged by a crash, fire, vandalism and other situations.

You select your deductible when buying a auto policy. You may be able to modify your deductible at renewal or midterm periods of the policy, provided that no losses have occurred during those periods. However, some insurers allow deductibles to be adjusted at any time, so check with your insurer's customer service department.

How to Choose a Car Insurance Deductible

It's important to understand how different deductible amounts can impact you. They impact how much you'll have to pay for your policy and how much you'll have to pay to get a claim covered.

Motorists are often presented with the following deductible options:

•$0 (or "zero-deductible" policies)

•$250 (or "low-collision deductible" policies)

•$500

•$1,000

At one choice insurance we work with you to get you the best rates with your auto insurance deductible.

The higher amount you choose, the less you'll pay in auto insurance premiums. However, higher deductibles mean you'll need to pay when you want to get a claim covered. The higher amount you choose, the less you'll pay in auto insurance premiums. However, higher deductibles mean you'll need to pay when you want to get a claim covered.

The same goes for a low deductible: a low deductible means higher premiums but also means a lower amount you'll have to pay to get a claim covered.

Policyholders often take the advice of raising car insurance deductibles to lower coverage rates. But a lot of that advice can vary from vehicle to vehicle and policyholder to policyholder.

Consider these two things when selecting your deductible:

•Can you afford the deductible out of pocket in the event of a claim?

•Are the premium savings worth the extra out-of-pocket payment in the event of a claim?

According to the Insurance Information Institute, raising a deductible from $200 to $1,000 can cut the cost of comprehensive/collision coverage by more than 40 percent.

More Charges Possible in Event of Claim

Drivers should understand they'll need to pay their deductible in the event of a claim. For example, if a motorist was involved in a crash that put the vehicle in a repair facility, the vehicle will usually not be released until the insured has paid their deductible.

If a motorist does not have the money on hand, they can risk additional charges such as storage fees from the repairer until the amount is paid and the vehicle is picked up. So it is crucial that policyholders choose a deductible they can afford to pay at the time of a claim.

Deductibles also Apply to Other Types of Coverage

Deductibles may be applicable to other forms of coverage such as personal injury protection (PIP) and uninsured motorist property damage.

The same relationship exists between premium and deductible levels for these types of coverage, though choosing a higher deductible for them will usually only lead to a small decrease in rates and may not be worth the premium savings.

Deductibles do not apply to "liability-only" policies.

How Deductibles Are Applied

Deductibles will be applied differently in instances that a vehicle is stolen (and goes unrecovered), vandalized or damaged beyond repair, because the policyholder won't have to pay the deductible in order to trigger the repairs that will be funded by the claims payout.

Since there will be no repairs made in those instances, the policyholder will receive a settlement determined between the insured and insurer. That agreed-upon amount will then be paid to the insured through a claim settlement check, minus the deductible amount the policyholder had selected on their auto policy.

Also, some states require that insurers waive any comp/collision deductibles if the claim is for windshield damages.

In the case of a PIP claim, deductibles also work differently. For instance, if an insured is injured in an auto crash, the car insurer will pay for medical expenses up to the policy limits, minus the deductible. The remaining amount due for medical care will usually be billed to the policyholder.

For assistance with your Auto Insurance in Addison, TX contact the professionals at One Choice Insurance. Located in Texas, we serve all your personal auto and homeowners insurance needs or

Call Us today! 214-702-0046

Experience the One Choice Insurance Difference!

Dallas, Frisco, Plano, Carrollton, Allen and Addison, Texas

No Comments

Post a Comment |

|

Required

|

|

Required (Not Displayed)

|

|

Required

|

All comments are moderated and stripped of HTML.

|

|

|

|

|

|

NOTICE: This blog and website are made available by the publisher for educational and informational purposes only.

It is not be used as a substitute for competent insurance, legal, or tax advice from a licensed professional

in your state. By using this blog site you understand that there is no broker client relationship between

you and the blog and website publisher.

|

Blog Archive

|